The market has been on a tear as of late. ‘One day these tides will turn and leave you nothing…’ but that’s not soon.

Where are we now?

Bitcoin remains in a bearish trend daily, but we are just a few bullish days away from a trend shift. Risk exposure in the market has made another bullish rotation and is setting up another. Retail sentiment has maintained bullish support.

What does all that mean?

The larger-scale bull market is still on. We are on the verge of the next breakout, which may propel us up towards the end of the year. It won’t be a straight shot, though. We may have to chop through plenty of resistance levels as we go, but weeks-long bearish action may be done for a while.

Let’s observe the latest changes in 4 key market metrics, but first… Did you miss the Q4 analysis I dropped last week? Check that out here!

Total Market Weekly Structure

https://www.tradingview.com/chart/FEeyCH3q/

No new changes. Last modification Sept 23, 2024:

By my rules, the weekly structure trend is still bearish. There are a few possible outcomes from here, but ideally, we will see an eventual close above 2.617T to confirm a trend shift to bullishness on the weekly timeframe. Otherwise, a close below 1.904T will invalidate the recent support structure and delay the bullish trend.

Below is the ideal scenario beginning with the low point at the turn of 2022- 2023, to a high point in March 2024 to a higher low in early September—the baby steps of a bullish trend (low, high, higher low…). Next, we need to close above 2.617T to confirm the trend shift (our higher high).

Total Market Daily Structure

https://www.tradingview.com/chart/25yQcZV1/

New changes!!

Last modification Oct 2 2024:

Since the support was confirmed at 1.862T, prices fell the confirmed resistance at 2.263T, and we recently rallied enough to confirm a support at 2.062T. We have the same low, high, higher low formation as the weekly chart beginning at the early September low. We now await the close above 2.263T to confirm a shift to a bullish trend (a higher high). Similarly to the weekly structure, a close below the structural support at 2.062T will delay the bullish shift

Much like last year the daily bearish trend shift that recently occurred in early September with the lower low close also occurred during the previous market cycle. It would appear that history will repeat itself as the shift then didn't result in significantly more downside than what had already taken place.

Crypto Money Flow

https://www.tradingview.com/chart/E249oVQY/

New changes!!

Last modification Sep 23 2024:

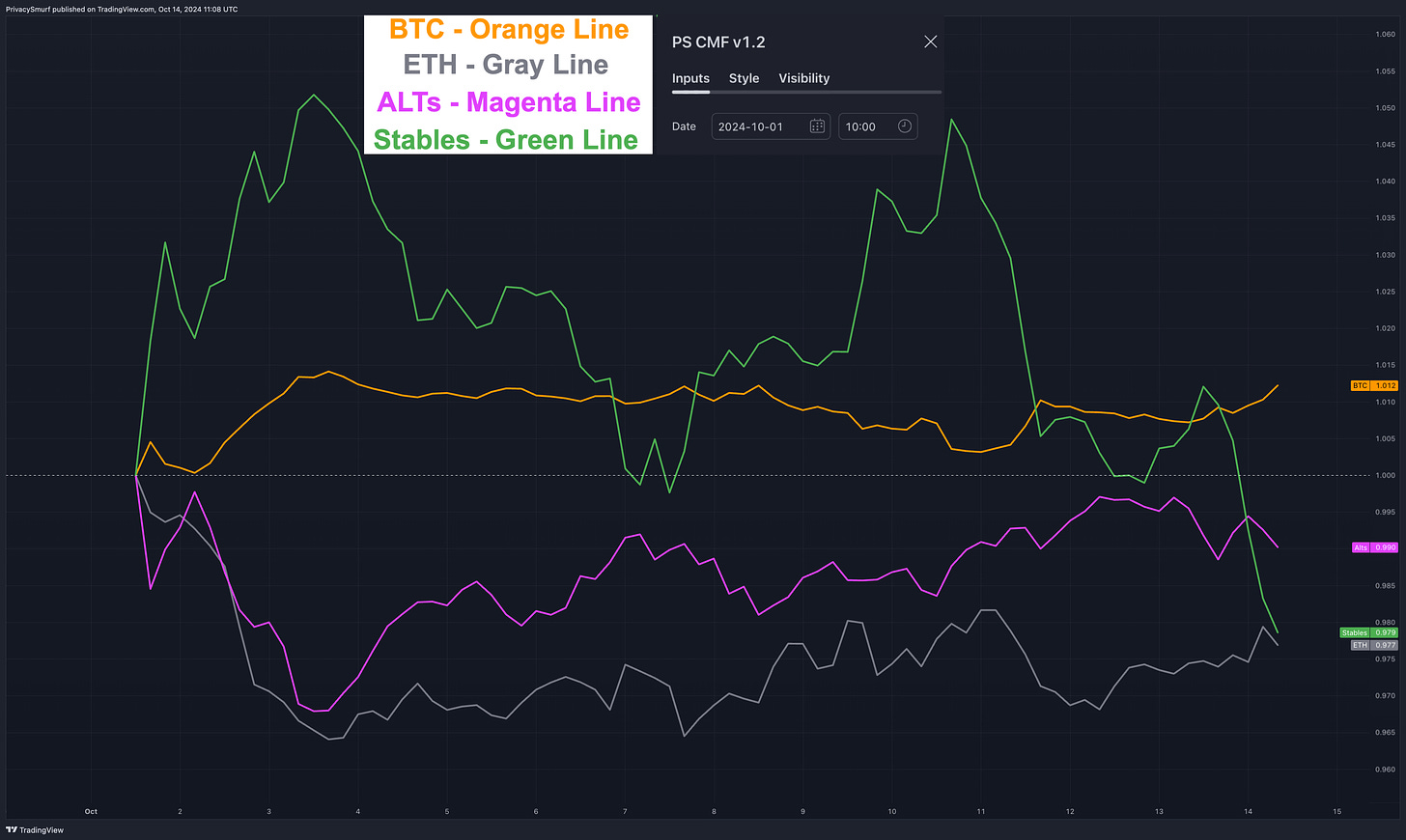

The starting point for the latest rotation on the Crypto Money Flow chart has been updated: October 1, 2024, at 10:00 UTC, as seen above.

In the image below we can see how the previous rotation has played out along with where we are marking the current rotation starting point.

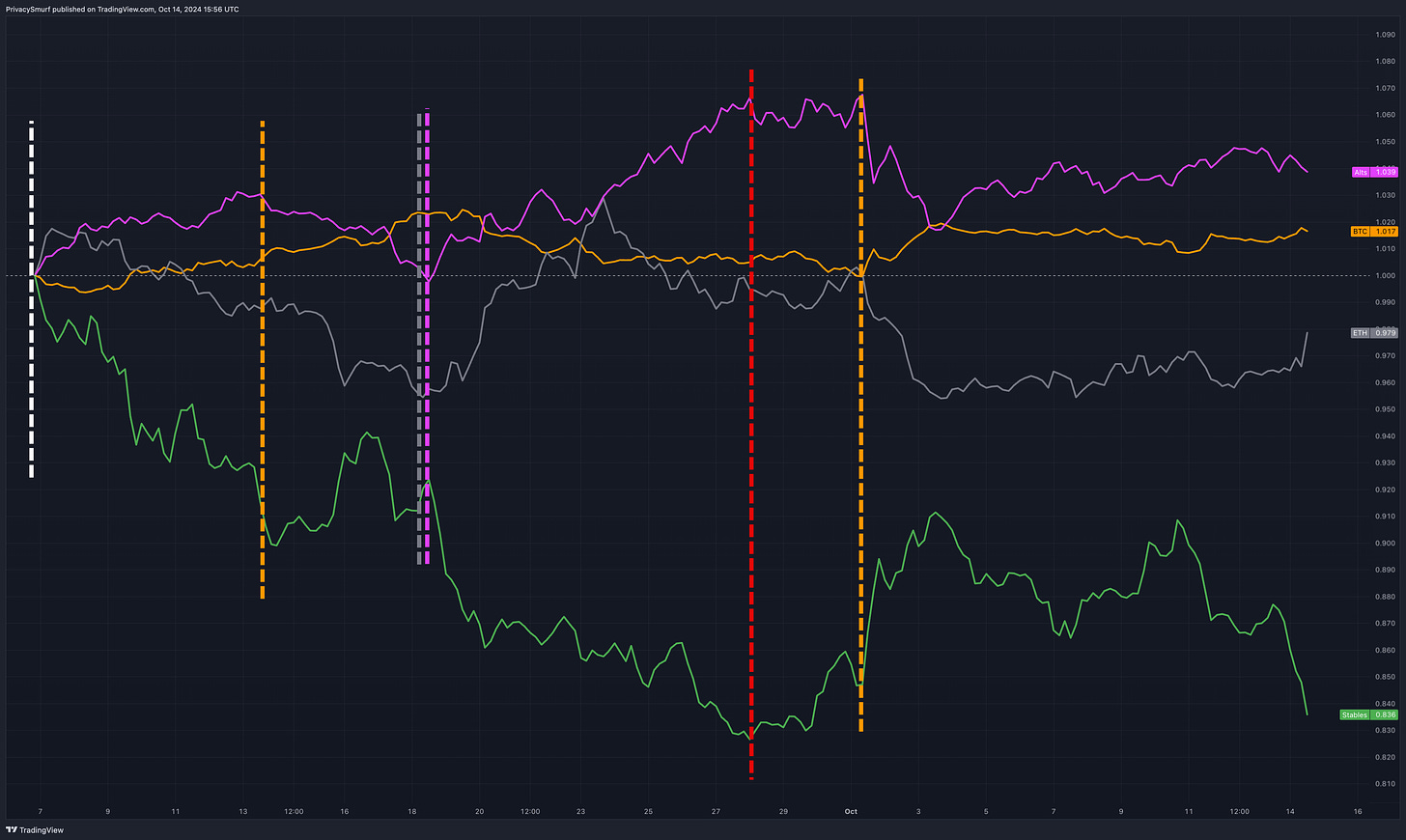

Stables continue to steadily lose capital as risk appetites increase. The segment right of the white line shows BTC and ALTs gaining in traders allocation (meme coins and various small caps have been performing well). Next, the right of the orange line shows BTC increasing with stables on the minor dip middle of September. BTC was bought up. Finally, right of the grey and fuchsia line the BTC gains were rotated into ETH and ALTs marking the final phase of the rotation. The ALT profit taking starts at the red line and next we see the start of our new rotation with BTC and Stables to increase again to show the beginning of a new cycle at the orange line.

Additional Crypto Metrics

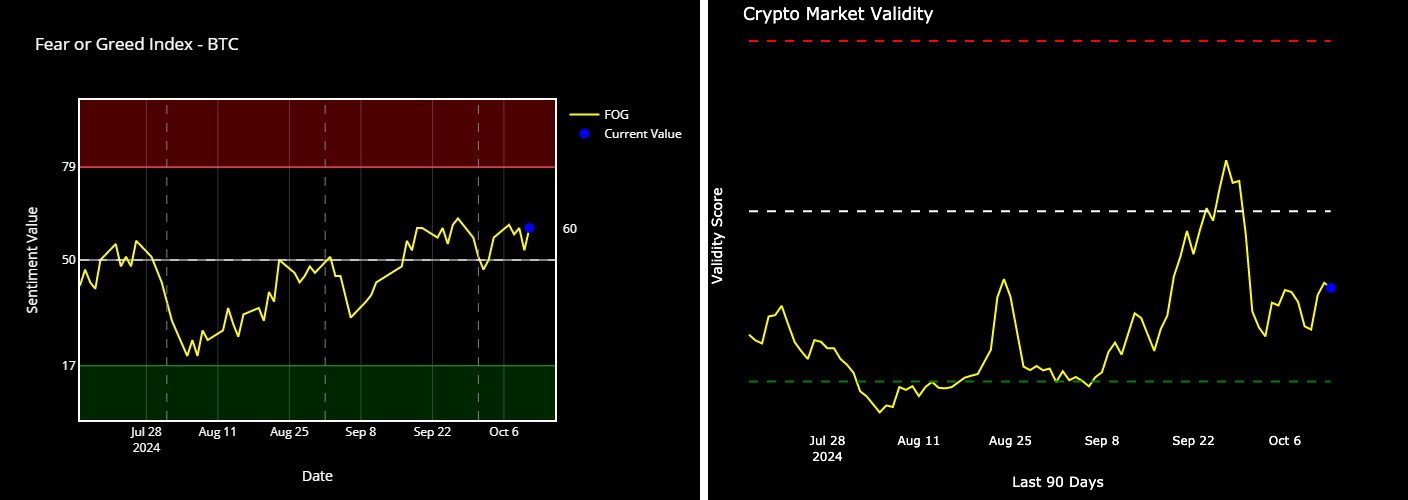

Retail sentiment has been consolidating over back over the midline. Traders are bullish but not enthusiastic yet. I imagine it will take prices over 68K to get into higher levels of greed and out of this of recent sentiment consolidation.

The Market Validity Score has rallied well out of the lower extreme and teased bullishness but did not hold up the last few weeks. It would be wise to scroll through and look for assets breaking out of resistances or charts that have not broken down into a bearish trend of lower highs and lower lows. These are the better assets to trade when the momentum returns.

What do we do with this information?

My short-term intentions haven’t shifted much from the last post but just may in the next one or two.

My money rotation interpretation shows we have played through a full market rotation from Stables to BTC to ETH & ALTS. Bitcoin exposure is the name of the game this week until it finds resistance, then look for the ALTs to run.

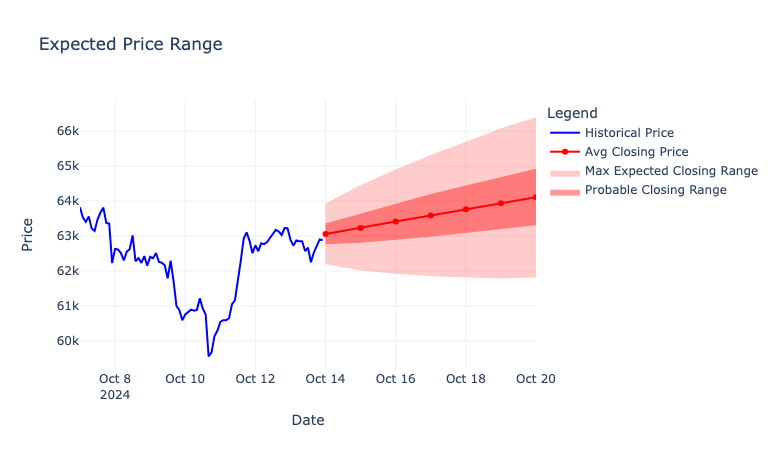

I’ve been working to bring some hard science into the art that is technical analysis. Stats would put closing prices between $62K to $67K this week for BTC.

This fits well in line with my analysis and charts at the bottom of the publication. I’m tentatively putting a support zone just below todays open at $63K and have restance levels that may or may not hold at $65.7 and $68.2K. I expect somewere in that upper range BTC will find it hard to continue trending and give other coins a change to move. I’d consider ALT breakouts and evaluate larger dip buying positions if/when BTC returns to 63K and holds that level.

I haven’t finished the work for this analysis on ETH, but my TA is putting a range low at $2430 and many levels of resistance starting at $2690 to $2830

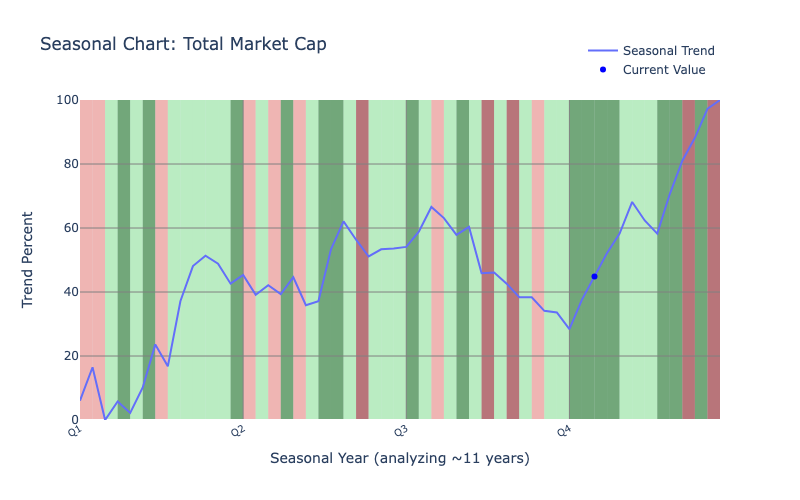

My long-term horizons are unchanged and I anticipate higher prices at the end of the year. The crypto market has struggles its way through all the seasonal bearish times and has no more historical headwinds for the year as shown in the chart below. Any major declines outside of the mid quarter profit taking are all new occurances.

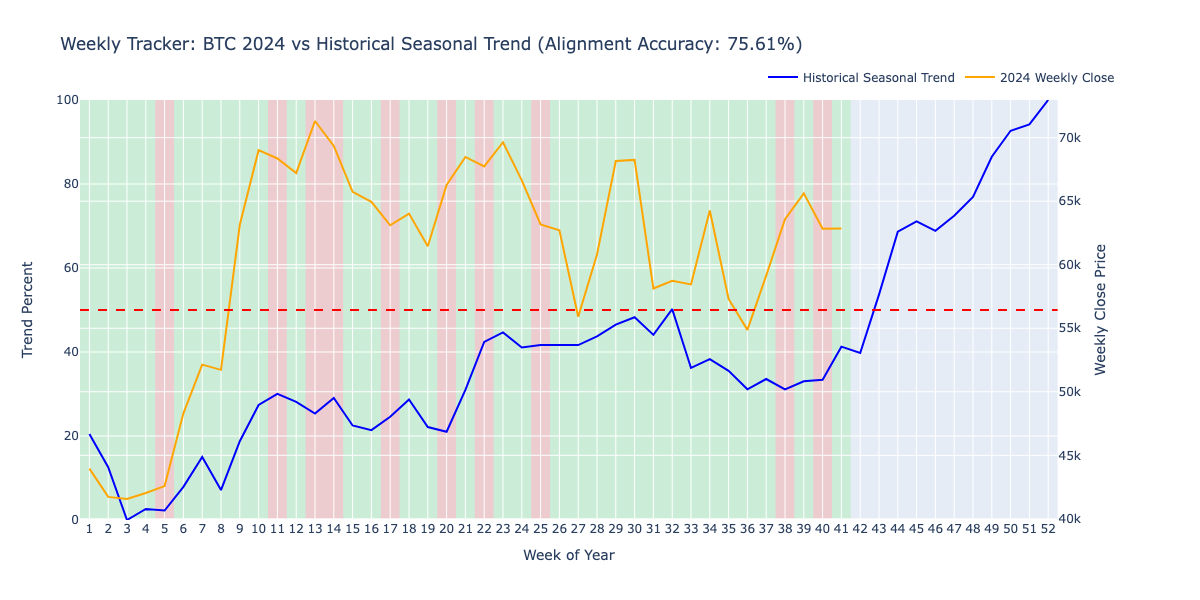

Same goes for BTC. This year BTC has very accuratly followed the seasonal path week by week over 75% of the time.

If you missed the last weekly update, on the daily chart it has signal a bullish trade based on bullish divergence. Initial target is around 74K and secondary target around 84K. This aligns with my expectations for pricing on the market top this year. Again this year, same as the 2021 bull run, I’m not expecting +100K before the years end.

That’s all for this week’s analysis.

Welcome to the beginning of the end!

You are a true fan of Technical Analysis. Here are some extras to dig into.

Did any of the above sections not make any sense? Try catching up with these explainer posts.

Click the links below if you need a refresher on the checkpoint elements.

Got any questions? Pop into the discord and chat.

*https://discord.gg/MuMP5VUeM9*

Read a post about what everyone is getting wrong about the Bitcoin Halving and BTC price action.

Below are the charts I use for my BTC, ETH, and ALT trading. I think I’ll start making short videos about each of them occasionally.

See you in next week’s market update!

@theprivacysmurf