So it’s been a little over a month since the last post. When I go quiet people do tend to get worried. Thanks for the concern but trust me there’s no reason to worry. Something to remember is that sometimes no news is good news (or at least you can be sure it’s not bad in my case). I could continue posting each week, but there’d be nothing to say as of late. As of close on Sunday, July 23rd BTC was less than a percent away from where it closed on my last post over a month ago. ETH was just over 1%. Technical factors just hadn’t changed enough to warrant commentary. Sometimes less is more in terms of content.

During the market downtime, I’ve been working behind the scenes to reorganize the Zenalytics products into a more sustainable structure. Substack is going away. The Zenalytics site (run on the Circle.so platform) is going away. This weekly update post will continue on Beehiiv and will remain free. You won’t need to do anything. All subscribers will be imported automatically. You’ll get an email tomorrow letting your know the transition has occurred.

All other content will be distributed through my public discord. You can follow along and join in the discussions there.

In the discord, the Position Playbook along with other older post styles will be updated regularly. Some new additions to the discord will be regularly updated custom watchlists based on several technical analysis methods I use. These watchlists can be imported into your Tradingview to keep an eye on yourself or set your own custom alerts for possible entries or exits based on the trading strategies and indicators that I’ve brought out in Tradingview over the years.

The educational site will be coming back to its original form. Site links will be up by the end of the week. I’ll make a quick post to the newsletter and in Discord with the link.

Now, back to your regular programming.

-BTC/USDT Daily Chart

https://www.tradingview.com/chart/jjSdFW4b/

From the last post:

"... We may be in a moment of consolidation..."

Since the last post, prices remained stagnant and the RSI (yellow arrow) continued the downward directionality suggesting a waning of bullish momentum. It closed below the midline on the 17th which would suggest a transition to a bearish influence on prices, making bullish price action harder than bearish price action. At the time of writing (Monday morning on the US west coast) BTC has crossed below the $29K level and hit initial bearish targets (blue arrow) signaled on my custom indicator the Correction Streng Meter (white arrow) on the July 14th close. The RSI is also crossing below the bottom adaptive band. Closing below that today would suggest more bearish impulsivity is incoming. The secondary bearish targets sit at around $28K. Coincidentally this level was also an RSI-dictated ceiling back in late May so this could be a potential bounce point. I would wait for the RSI to be closing back inside the bands though before I would confirm a potential floor.

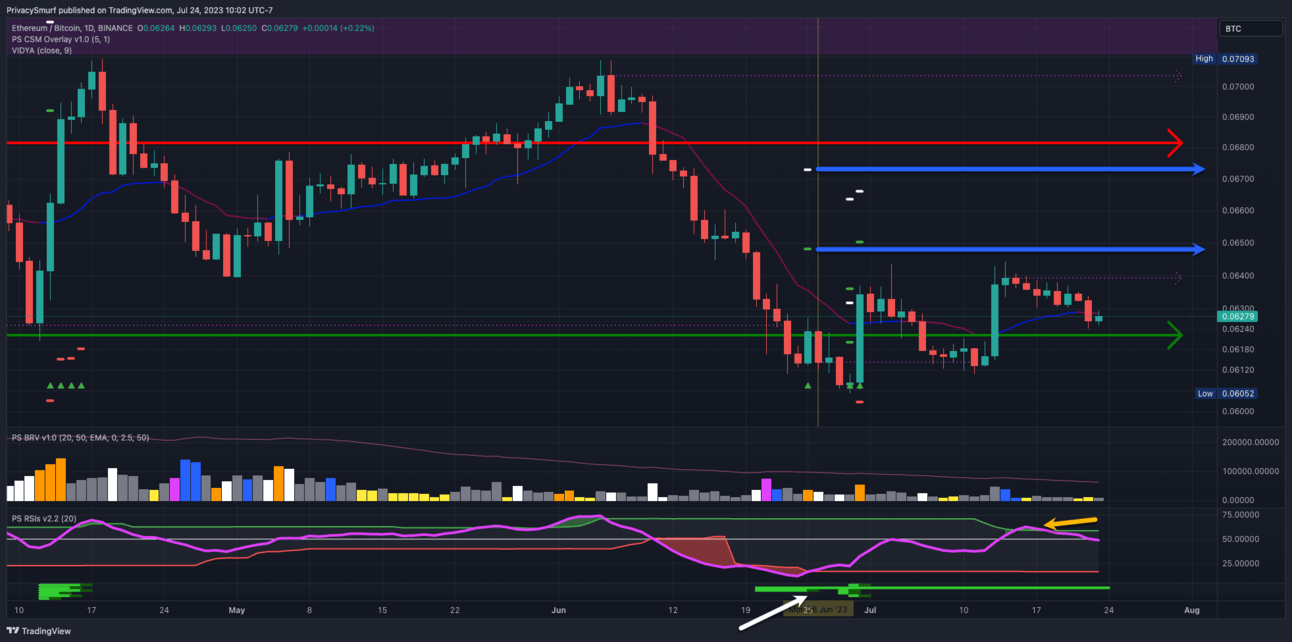

ETH/BTC Daily Chart

https://www.tradingview.com/chart/gTkSjkj6/

From the last post:

"... bounces from here it would signal an outperformance of ETH and (likely other) ALTs over BTC…"

Since the last post, the bullishness has come in spurts but has been slowly bled off. The RSI (yellow arrow) has continued its path upwards suggesting the waning of bearish momentum. It closed above the midline on the 15th which would suggest a transition to a bullish influence on prices, making bearish price action harder than bullish price action. The follow-on selloff set a higher low than the previous selloff low on the 11th. The RSI fell back below the adaptive top band on the 19th creating an expected ceiling at the 0.064 level. A close above this point may coincide with another break above the top adaptive band which would both establish a new bullish trend and may be accompanied by bullish impulsivity in price action. With the BTC chart showing potential weakness this may just translate to ETH and ALTs not declining as much as BTC and not necessarily increasing in value. The bullish trade condition with targets (blue arrows) around 0.0648 and 0.0673 signaled by the CSM (white arrow) on the 25th are still in effect. At the time of writing (Monday morning on the US west coast) the RSI is flipping back and forth above and below the midline. Consolidation in between the green support arrow at 0.062 and the RSI-dictated ceiling at 0.064 appear to be the course until bulls or bears can decide who is in charge

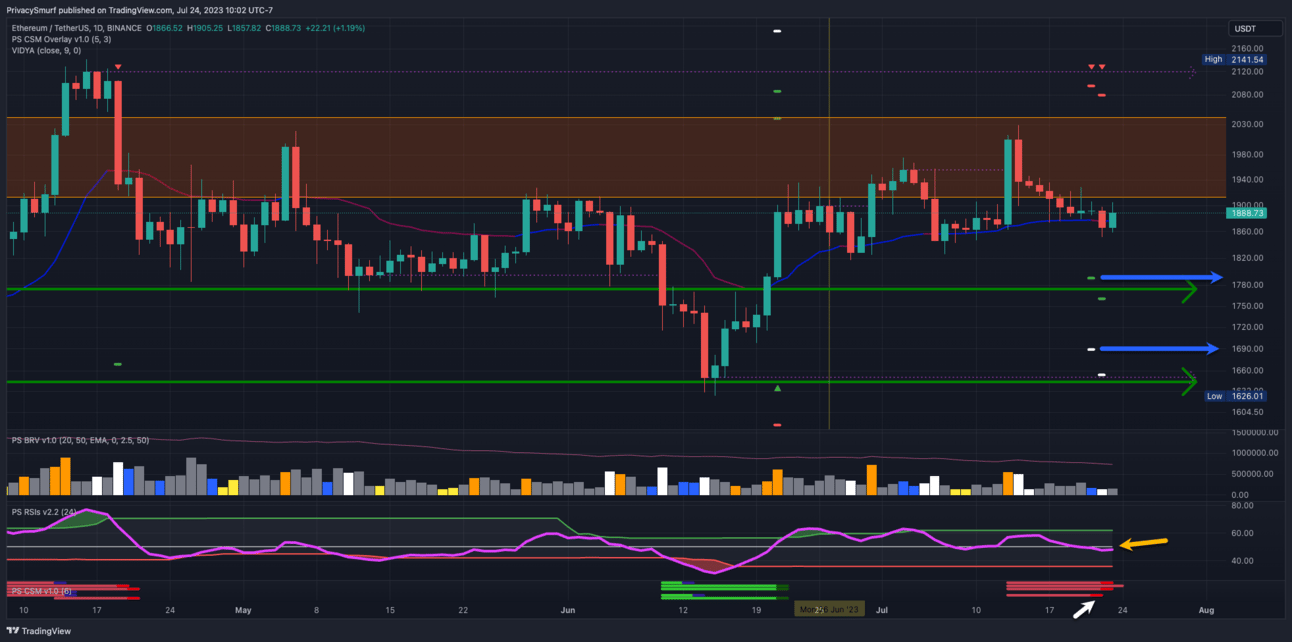

ETH/USDT Daily Chart

https://www.tradingview.com/chart/xbB6lkZu/

From the last post:

"...ETH and ALTs have more room to run in the next bullish spurt… "

Since the last post, the RSI (yellow arrow) made a second effort above the adaptive top band but created a lower high than the first breach made the week of the last post. Since that time prices set a bearish divergent higher high suggesting a failure from the new highs instead of a bullish continuation. The third new higher high close on the 12th also was paired with another lower high on the RSI, a deeper bearish divergence. The RSI now has closed under the midline which would suggest a transition to a bearish influence on prices, making bullish price action harder than bearish price action. The CSM (white arrow) has also signaled a bearish trade trigger with targets (blue arrows) at $1790 and $1688. The initial target sites above a prior RSI-dictated floor and green support arrow so I’d expect even a bounce from that level. With the ETH/BTC chart showing signs of potential strength and the RSI not near an adaptive bottom band cross the potential decline here may not be as extreme as BTC. A daily close under $1846 will cause a loss of bullish price structure.

I’ll close with a snippet from the last post. The bullish trades from the CSM are still in effect.

“… the Correction Strength Meter fired off bullish trade signals with targets around $2080 and $2190. There is no specified length of time for those targets to be hit. It may take some consolidation first...”

I’ll try to be better about the silence when the market gets dull and at a minimum say there’s nothing new to report. Thanks for your continued patience with me. I do hope to see you all in the discord. I chitchat and drop analysis and critiques there daily and that’s a great medium to reach out to me if you have any thoughts, comments, questions, or concerns.

@theprivacysmurf80