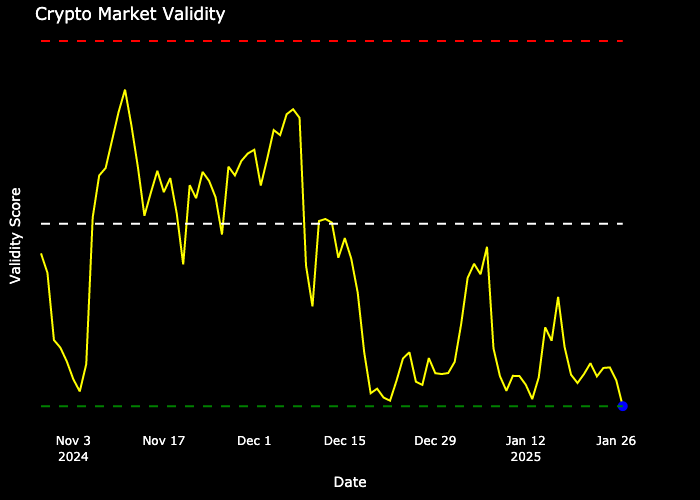

Above is my custom metric, the Market Validity Score.

Here’s a refresher on it.

Market Validity Write-up

In broad strokes, it suggests that the vast majority of assets display a bearish structure, which provides an objective, non-emotional cue to “buy when blood is in the streets.”

This typically would be a sign to start evaluating DCA buys across the market. There's never been this many signals in a bull market before, and I've discussed my reservations about this signal going into the future. Still, even so, it's too early to make any decision on using/not using it anymore.

The timing of this signal, however, is pretty much in line with a lot of other bullish elements. Seasonality is at its yearly low point. Cyclical price patterns are at a low for the quarter over the next week or so. Prices are at the low ends of the ranges. Remember that any purchase based on this signal is Dollar Cost Averaging, not some leveraged long. This signal does not mean a bottom is in.

AGAIN. To be clear, this doesn’t necessarily mean prices can't go lower. Please execute caution when considering your purchases. It's best utilized for things you have a long-term conviction on rather than short-term speculative ideas.

@ThePrivacySmurf