It was a long day out in the water yesterday, and I wasn’t able to get the update out. Something I have to keep in mind is always to maintain a healthy respect for nature. I was in the Marines (I know how to swim while carrying a rifle and gear) and am in pretty good shape. Regardless, the ocean is strong, and despite my best efforts, I got shoved into some rocks and scraped up my thigh and hand. I’m fine, though, so no worries. It was a lovely day, a reminder that nature can be a beast.

…Snake Juice is basically rat poison…

📌 TL;DR / Smurf’s Summary

Bitcoin requires monitoring after a breakout rally, prompting caution as we near resistance (~$94K-$98K); key support is $82K-$85K for a potential swing entry. Ethereum and Altcoins are lagging, offering selective breakout chances but require tight stops due to higher risk from BTC dominance in the event of a retrace.

🚦 Trader Traffic Light

BTC Trades: 🟡

Yellow Light since the swing from $78K and breakout from $85K have played out now. New exposure is riskier being so far above supports. Evaluate continuation breakout over $92K.

ETH & ALTs Trades: 🟡

Yellow Light. I’m still not looking for dip buys. With ETH and ALTs still lagging I’m focusing on breakouts with tight stops. There’s added caution since the market caps of ETH and ALTs were still dwarfed by BTC’s market cap growth. A pullback on BTC could have a dire impact on the rest of the market since it is still more dominant.

🔍 Where Are We Now?

Market Structure: Bearish daily structure, yet short-term bullish signals confirmed.

Retail Sentiment: Bullish

Current Positioning:

BTC spot long at $78K (trimmed small profit @ $91.5).

Actively evaluating ALT breakout trades with tight stops.

What are the Technicals?

Definitions:

Weekly Closing Range: Created with Bayesian statistics and linear regression. More on that here.

RSI (Relative Strength Index): Momentum indicator showing speed and power of price action.

Divergence: When price action is going one way but momentum is going the other, suggesting the current price trend might be losing power.

📈 Technical Deep Dive (BTC)

Price Action:

Support zone at $82K-$85K; Resistance zone at $96K-$98K; invalidation of bullish bias if daily prices close below $74K.

Weekly Closing Range is forecasted at $82.3K - $89.9K by Sunday. 13 out of 25 (52% efficiency)

Indicators & Oscillators:

RSI: Suggesting continued impulsive bullish price action because measurements are:

Currently above midline - momentum is generally bullish, it’s easier to go up than down.

Currently above adaptive top band - price action is on a momentum breakout to define a new ceiling.

Divergence Signals: Confirmed bullish divergence targets are placed around $94K and $104K. I’m not optimistic about the secondary target.

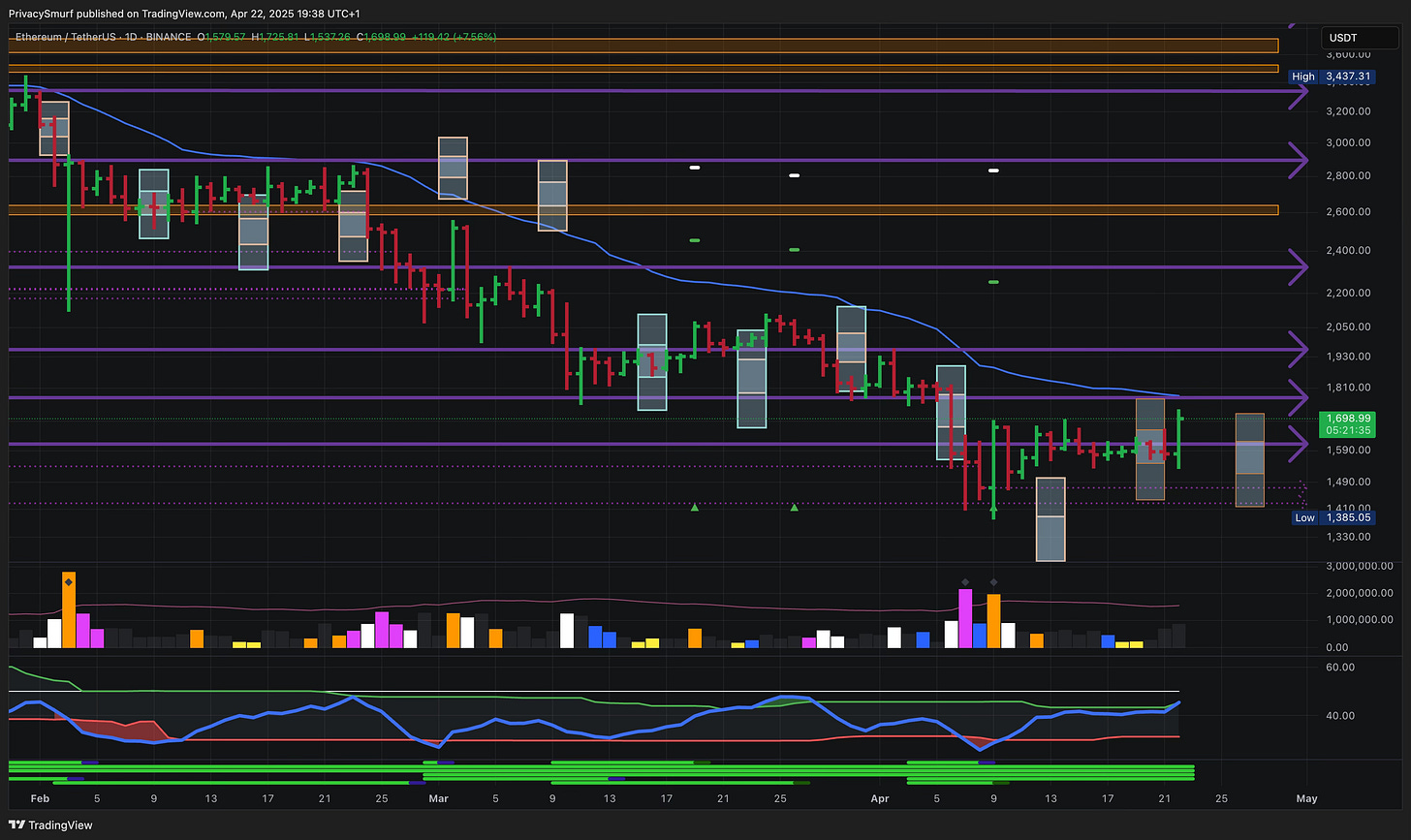

📉 Technical Deep Dive (ETH & ALTs)

Price Action (ETH):

Support zone at $1400-$1500; Resistance at $1775 and $1960; invalidation of bullish bias if daily prices close below $1400.

Weekly Closing Range is forecasted at $1417 - $1717 by Sunday. 12 out of 24 (50% efficiency)

Indicators & Oscillators (ETH):

RSI: Suggesting continued consolidation in price action because measurements are:

Currently below midline - momentum is generally bearish, it’s harder to go up than down.

Currently inside adaptive bands - price action is on a fluctuating normally between supports & resistances.

If today’s price action were to close right now (as it’s pending outside the top adaptive band) I’d expect a breakout like we’ve seen recently in Bitcoin.

Divergence Signals: Confirmed bullish divergence targets are placed around $2250 and $2800. I’m not optimistic about the secondary target.

ALTs: Slightly lagging behind ETH but in a similar technical state and on the verge of bullish impulsiveness. Focus on ALTs that have been up trending and are at critical resistance levels. Wait for breakouts that allow for tight stop losses.

🧭 What’s the Plan?

**🧭 Trading Plan & Scenarios**

* **Bullish - BTC Breakout Continuation:**

* Condition: Close > $92K

* Action: Eval. new leveraged longs

* **Caution - BTC Consolidation:**

* Condition: Closes < $94K & RSI back inside bands

* Action: Consider profit taking on short term longs

* **Bearish - BTC Bullish Invalidation:**

* Condition: Close < $74K

* Action: Close short-term spot BTC position

* **ALT Rotation Confirmed:**

* Condition: BTC < $94K, & BTC.D stable or dropping, & OTHERS.D increasing

* Action: Eval. ALT breakouts

---

**📌 Risk Management**

* **Stop-Losses:**

* BTC: Daily close < $74K

* ALTs: Placement under clear pivot point ideally < 12% below entry

* **Position Sizing:**

* BTC: Moderate entries

* ALTs: Small entries

🔮 My Long-Term Market Reflection

Macro Cycle Status:

Bull market still intact but in a phase that in the past lead to bear market confirmation.

Historical Comparison:

Similar patterns to the prior bull market suggest caution; historically, failure to breach all-time highs before turning back down signaled bear market onset.

Personal Expectations:

As time progresses without setting new price highs, we continue to shape the market similarly to the last bull market.

In a perfect mirroring scenario, we would have already hit the lowest low and initiated a rally, only to establish a macro lower high over the next 5 weeks before transitioning into a bear market. This timeline matches very well with the current peaking window for the daily chart, according to the quarterly forecast. Read that if you haven’t yet.

Today and tomorrow are critical to monitor. We are approaching the zone underneath the trade targets. It’s the floor we broke down from and is our current resistance. In the last bull market, bulls could not recover over that level and price rolled over. I don’t want to be left hoping for prices that are too high for what turns out to be a bear market rally, in hindsight.

We are in the first timing window of the quarter for a BTC peak.

I’ve trimmed some BTC profits above $91K but there aren’t any intraday signals yet to support taking any more than a third of my position out yet and ideally I’ll have an opportunity in early may to purchase from a lower that $92K and above $76K.

🎯 Key Takeaways

BTC: Monitor $82K-$85K support if a pullback comes; consider securing profits from $92K - $94K resistance. Bullish bias invalidated below $74K and possible bear market confirmation.

ALTs: Seek selective breakout trades with tight stops; ETH/ALTs remain weaker than BTC.

Context: Be cautious – current market structure resembles historical cycle tops. Stick to risk plan, don’t get sucked into hype.

@ThePrivacySmurf