TL ; DR: When the January Barometer fails to trigger by June, deep drawdowns have followed. Knowing the odds can prevent you from getting buried.

For the past two years, I’ve shared an extremely simple trade idea that has outperformed buy-and-hold: the January Barometer strategy. But what happens if this year’s setup doesn’t trigger? Could the absence of a signal itself tell you something important?

What is the January Barometer strategy?

You start each year in cash and wait for a bullish momentum signal: if any month before July closes above January’s high, you buy and hold through year-end; if not, you stay in cash until next January. Historically, for Bitcoin, this single-trade approach triggered nine times in fifteen years and delivered a compound annual growth rate of 264%.

The last two trade setup posts can be found here and here.

What’s in the data?

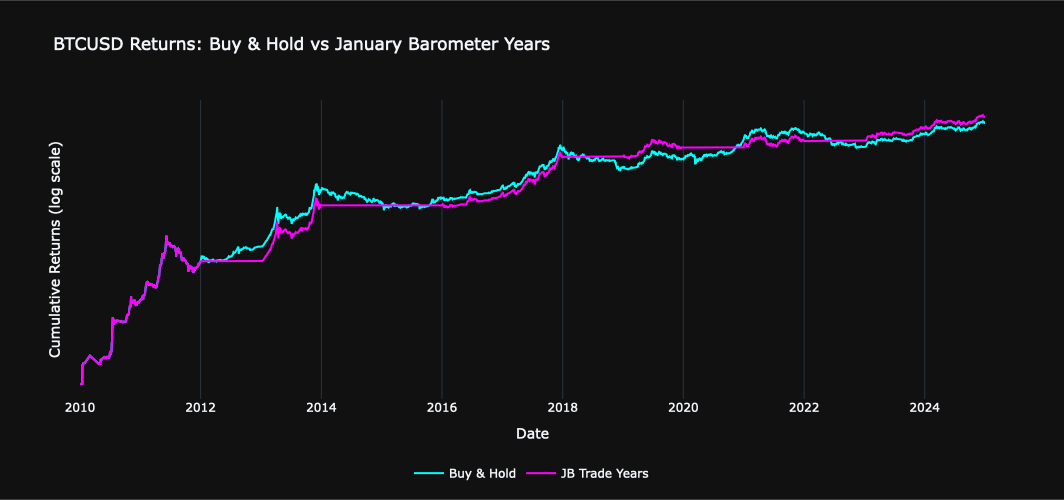

Below is a chart comparing the performance of this strategy (magenta) against a straight buy-and-hold (teal) from 2010 to 2024.

The cumulative-returns chart shows the January Barometer strategy (magenta) outperforming the straight buy-and-hold approach (teal), capturing confirmed early-year momentum and side-stepping deep drawdowns by being in cash when bullish momentum is absent.

Below is a table comparing the performance of this strategy from different starting years.

The rolling-window table reinforces this edge over buying and holding, with January Barometer trades delivering higher returns across nearly every start point.

Why does this matter to you?

The familiar line “time in the market beats timing the market” glosses over the pain of deep drawdowns and the power of bullish momentum. Parking funds in cash is not a lost opportunity; it is an active risk-management choice that shields capital and primes you to buy when a statistical edge returns. You do not need to master chart patterns or oscillators; instead, define a clear rule set, back-test it, and rely on the resulting probabilities. History shows that patient traders who follow disciplined rulesets can sidestep the worst sell-offs and redeploy their cash when conditions improve, compounding their gains faster than those who ride every wave.

The signal in no signal.

As we approach the June close, no monthly close has occurred above January’s $109.3k high. Let’s examine years when the Barometer failed to trigger for the insights when there is no trigger to act:

Positive no-signal years

2012 – July closed above January high and ended the year +44.5%

2015 – October closed above January high and ended the year +13.8%

2020 – July closed above January high and ended the year +155%

Negative no-signal years

2014 – January high never broken, price ended -67.6 %

2018 – January high never broken, price ended -78.6 %

2022 – January high never broken, price ended -65.5 %

The Takeaway.

If any month past June can close above the January high, there’s still an argument to be made for follow-on bullish momentum through the yearly close. If not, the average return for the year is ~70%. Placing this in the current context, a 70% drop from the 2025 open would result in a $ 28k price tag for BTC.

To be completely clear, I AM NOT advocating for that price point. I am showcasing the hidden edge that comes from knowing when to stand aside and not being blind to the possibilities.

Without any filtering, the odds of a red year for BTC are 20%, as three out of fifteen years in our sample size ended in a negative close. The odds of a red year more than double to 50% when we consider the annual outcome with the failure to signal a Barometer trade by July. While 50% is a coin flip, it’s still significantly worse odds of a red year than before.

The data set is small, yet the pattern is consistent enough to warrant attention. The absence of a January Barometer trigger isn’t noise—it’s a clear warning the market may be conceding its gains. Sitting in cash during non-trigger years preserves your capital and primes you to re-enter when the odds swing back in your favor. While it’s too late now to start the year in cash, if no entry signal comes before the June close, it may be worth evaluating your positions and consider the securing of some partial profits on your gains if you are up for 2025 or ensure you are in a position capable of withstanding significant drawdown. Hope for the best, but recognize the odds/risks and plan for the worst.

@ThePrivacySmurf

Yo, this January Barometer thing is kinda wild. Like, no signal actually meaning you should be careful? That’s lowkey smart, not just blindly holding. But damn, a 70% drop to 28k BTC sounds brutal. You think people are actually ready to pull profits or will most just hold and hope for the best?

I gave you a dm, let's connect!